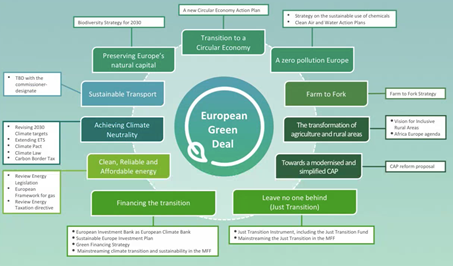

GRI kicked off the summit with insights on the EU Green Deal and the EU Non-Financial Reporting Directive current revision. The EU is positioning itself as a global leader when it comes to sustainability, hoping to create a ‘Brussels effect’ and worldwide standards. Launched in December 2019, the European Green Deal is the EU’s growth strategy to make the EU’s economy sustainable – where there are no net emissions of greenhouse gases by 2050, where economic growth is decoupled from resource use and where no person and no place is left behind. A European Climate Law has been proposed by the European Commission (EC) to turn carbon neutrality political commitment into a legal obligation. Find out more here.

The EC also committed to review the non-financial reporting directive in 2020 as part of the strategy to strengthen the foundations for sustainable investment. The Commission launched in February a public consultation on the review of the NFRD. Some consultees voiced that effective standards should be globally harmonised and mandatory, as many asset managers have a global investment horizon and comparability of information is a key issue. Sustainability global standards could be set within the framework of the IFRS and the IASB in the future. Going beyond the current approach of non-binding guidelines, the EC explores the endorsement of existing or possible future standards and a broader strengthening of the provisions of the NFRD. Having no time nor desire to wait for a global solution, the EC will propose a comprehensive, credible and comparable set of reporting standards to the EU Council and Parliament in February 2021. The EU won’t create standards from scratch, and will tap into the main existing standards – the holistic, multi-stakeholders based and already widely used GRI standards might be well positioned.

Beyond Europe, global initiatives are ongoing among standards setters such as the WEF/IBC initiative (find out more here), UNGC CoP revision (find out more here), the GRI, CDP, CSDB, IR, SASB shared vision (find out more here), GRI & SASB collaboration (find out more here).

We face an increasingly complex global tax landscape and scrutiny for tax transparency are required from a variety of stakeholders for a long time now. Moreover, the United Nations underlined in 2015 the vital role taxes play in achieving the Sustainable Development Goals as they are a key mechanism by which organizations contribute to the economics of the countries in which they operate. The financing gap to achieve the SDGs in developing countries is estimated to be US$ 2.5-3 trillion per year (UNCTAD World Investment Report, 2014) while around 30 of the 75 poorest countries collect less than 15% of GDP in taxes (OECD, Platform for Collaboration on Tax, 2018). It also goes without saying that tax havens cost governments a lot in lost corporate tax revenue.

The GRI’s new reporting standard on tax (GRI 207) enables organizations to address stakeholder expectations for tax transparency a comprehensive way. Launched at the end of 2019, the standard will come into force for reports and other documents published from January 2021. It allows organizations to report on tax practices, strategy, governance and risk management. The standard introduces a country-by-country reporting on business activities, income, profits and taxes; and also calls for justifying differences between tax regimes. GRI 207 is also connected to the OECD BEPS Action 13 report (find out more here)

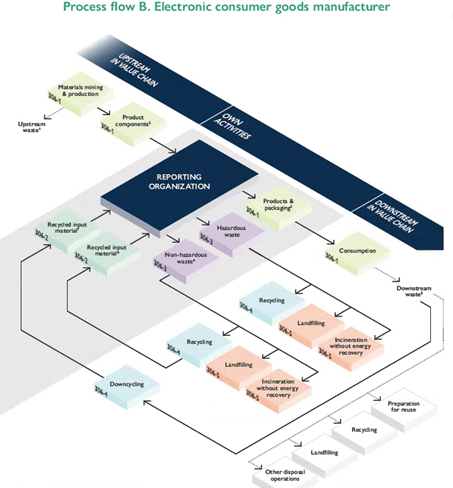

Waste management is a global issue whose complexity is still rising. Waste generation is far from being decoupled from economic growth and some waste streams (e-waste, renewable energies, covid-19 masks, etc.) are gaining weight.

Developed in 2020, the new standard GRI 306: Waste 2020 will be mandatory from January 2022. Its main purpose is to better reflect the relationship between materials and waste, in order to help organizations understand how procurement, design and use of materials lead to waste-related impacts and identify opportunities for circularity and waste prevention. It encourages organizations to assess the waste generated throughout the value chain, prompting them to recognize responsibility for upstream and downstream waste-related impacts. The standard helps identify management decisions and actions that can lead to systemic change.

Other GRI topic-specific standards have been revised to to stay as close as possible to changes in standards and regulations as well as best practices around the world.

Defined in 2018, the standard will be mandatory from January 2021. It mainly aims to better align with the CEO Water Mandate Corporate Water Disclosure Guidelines and the CDP questionnaire 2018 relating to water but also to better understand the quality of the discharged water (indicator initially present in GRI 306: Effluents and waste 2016), water consumption (new indicator measuring water not returned back to the environment), geographic sensitivity (with an emphasis on impacts within areas under water stress) and impacts in the supply chain.

Developed in 2018, the standard will be mandatory from January 2021. It mainly aims to align better with the ILO (International Labor Organization) instruments and the ISO 45001 standard, to understand better the impact of the organization through a new, more precise definition of the term “workers” referring to employees, workers whose workplace is controlled by the organization and those affected by the organization’s business relationships (suppliers, partners, etc.). The new standard also takes a more holistic approach by further covering health promotion and lifestyle risks. Finally, the notion of hierarchy of controls has been introduced to encourage a systematic approach to improve health and safety, eliminate hazards and reduce risks.

Sector standards provide information on likely material topics for an organization in a given industry. They enhance the technical features of the GRI standards and the cross references with existing frameworks. The sector standards are built through a transparent and multi-stakeholder process, and are based on recognized instruments. Any organization in the sector will have to take these standards into account when preparing reports. If an organization identifies a topic as material in an applicable sector standard, the sector standard will also help it determine what to report for that topic.

The sector standards under development are oil & gas, coal and agriculture and fisheries. Find out more here. Sector standards will be developed for other prioritized sectors – prioritization based on the size of the sector, the importance of their impacts as well as their likelihood.

GRI recently held a series of webinars focusing on the impact of business and reporting in the COVID-19 era and shared key takeaways during the summit. The role of sustainability in designing the ‘new normal’ goes through first and foremost the employee well-being and company survival, but also through partnerships, stronger focus on transparency and sustainability, as well as the need to rethink, rebuild and innovate.

It was interesting to note that 85% of participants think sustainability reporting prepares companies to evaluate risks and resilience in a more holistic way while the same proportion think that risk management will be an increasing focus in the coming sustainability reports.

More than ¾ underline that companies need to reassess whether current material topics accurately reflect stakeholder expectations and the evolution of the sustainability context.

Among the sustainability topics which should be emphasized/added in 2020 reporting as a response to the COVID 19 crisis are: :

76% of companies will change the way they prepare their sustainability report as a consequence of COVID 19 including:

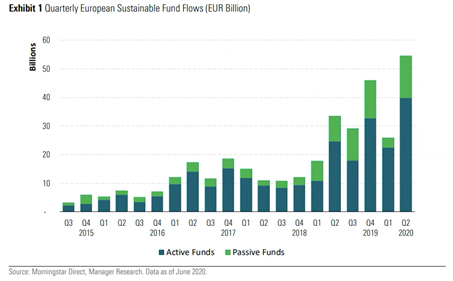

Martina N. Macpherson, SVP, Strategic Partnership & Engagement – Moody’s highlighted investors are increasingly incorporating sustainability into their investment portfolios and their stewardship and engagement strategies.

There is a rising global momentum around ESG investing mainly coming from the evolution of normative and regulatory environment. There are rising signatories of UNPRI (United Nations Principles for Responsible Investment), UNEP FI PRB (UN Environmental Program Finance Initiative’s Principles for Responsible Banking) and PSI (Principles for Responsible Assurance). When it comes to regulations, the EU is taking the lead with the EC Action Plan for Sustainable Finance (EU Taxonomy, EU Regulation on sustainability-related disclosures in the financial sector) while the IFRS (International Financial Reporting Standards) dynamics on extra-financial accounting are ongoing.

There is also an accelerating corporate focus on sustainability with 90% of S&P 500 companies publishing CSR reports in 2019 (51% GRI, 25% SASB, 5% TCFD, 36% SDGs, 65% CDP). A rising attention is focused on the “S” pillar when it comes to ESG (Environment, Social, Governance), especially triggered by the COVID 19 pandemic with expectations in terms of social resilience (education, transport, health, etc.) and just transition to tackle climate change.

ESG pillars are more and more integrated into management process from governance (creating a sustainability body responsible for onboarding across the company and its value chain), stakeholders engagement & materiality assessment to identify risks and opportunities, strategy & KPIs to set appropriate goals, reporting to communicate progress to stakeholders and assessment to have performance reviewed by third-parties and to grasp the external perception of the company’s management. Beyond annual ESG ratings – which face divergence in terms of measurement, assessment scope and weights – there is a lack of real-time ratings to enlighten investors – always looking for consistency, comparability, reliability and clarity of ESG data disclosures.

The sustainability software solutions provider Greenstone covered three of the biggest challenges that companies are facing when reporting on climate change during the COVID-19 pandemic:

With 10 years left to reach the goals, GRI reminded the audience that the progress is still very slow, with a step back because of COVID 19 – the world is not on track to meet the 2030 Agenda. Find out more on the annual SDGs progress report 2020 here.

When it comes to report on progress, there is still few member states presenting VNRs (Voluntary National Reviews). The private sector’s role in the VNRs is still limited with only 45% referring to CSR and sustainability report. Tools have been developed to help companies reporting on the SDGs and are available here.

Michel Washer, Deputy Chief Sustainability Officer -Solvay, then underlined the importance of creating shared value, of understanding the ability of companies to create value over the short, medium, and long term depending on the availability of different capitals (financial but also social, natural, etc.), of understanding and managing impacts across the value chain. Beyond integrated reporting, reporting on the SDGs allows the company to integrate its activities into a global and sustainable economy. In that vein, Solvay has also worked on its purpose to ensure a sustainable business model.

GRI concluded the event reminding the importance of aligning with the GRI quality principles to maximize the reporting quality:

Rajesh Chhabara, Managing Director- CSRWorks International wrapped up sharing its “5 C” challenges to ensure reporting quality:

This 5C cycle has in many cases been disrupted by the COVID19 pandemic. Companies should leverage their resilience capacity, and start training their team to have everybody on board towards sustainability.